Canada Revenue Agency

The page Local Church Income Tax describes the process and importance of submitting your annual T3010 as well as a T1235 on time. It is important to note that submitting your T1235 does not update the list of owners and directors with your CRA account. Adding and updating your list of owners and directors with your CRA account is a separate process. The process of updating your church CRA account’s list of owners and directors is described below.

UPDATING RECORDS

Who can update the CRA records? Only someone listed as a director/trustee on last year’s T1235 can mail or fax (613-954-8037) a letter to the Charities Directorate to update the CRA list of records. A person listed as a director or trustee on the previous year’s T1235 can fax a request for updates to the list of records with CRA for your church. Fax is actually the fastest way to complete the process (I know, it’s the government!). If you need to call, the best time to call Charities Directorate is first thing in the morning, 9am. For your reference, click on this CRA link to search for your local church records with the CRA website for the latest posted returns.

Here is a sample letter to Charities Directorate that you could use to request a change: Director Change Template.

SETTING UP YOUR ACCOUNT

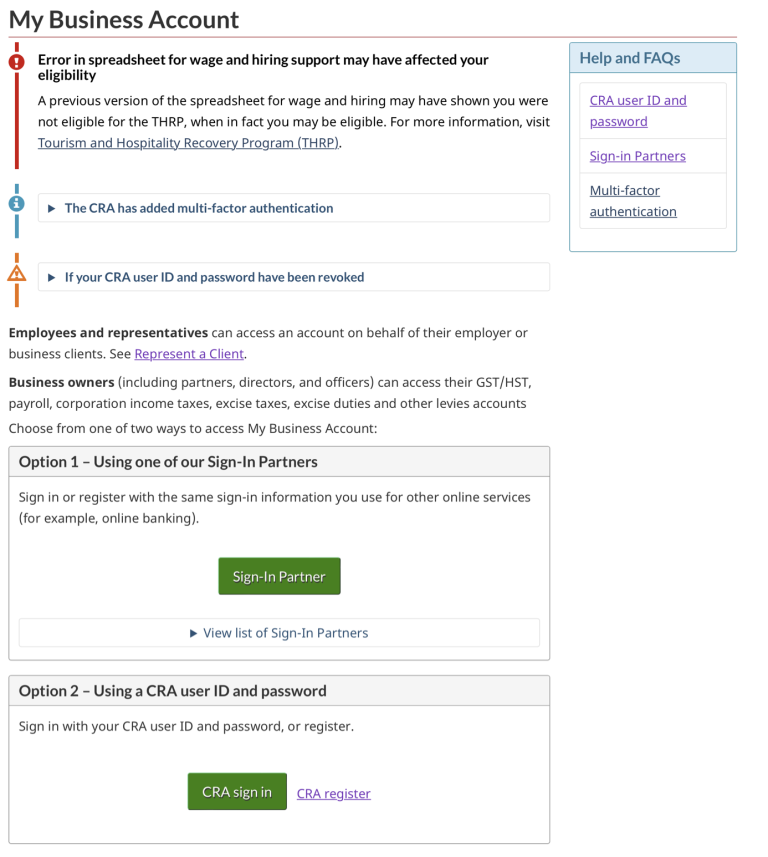

To confirm an update, visit the CRA small business portal as seen below. You can use your own personal CRA login (or partner login such as your bank login) for sign in. You should not create a separate login.

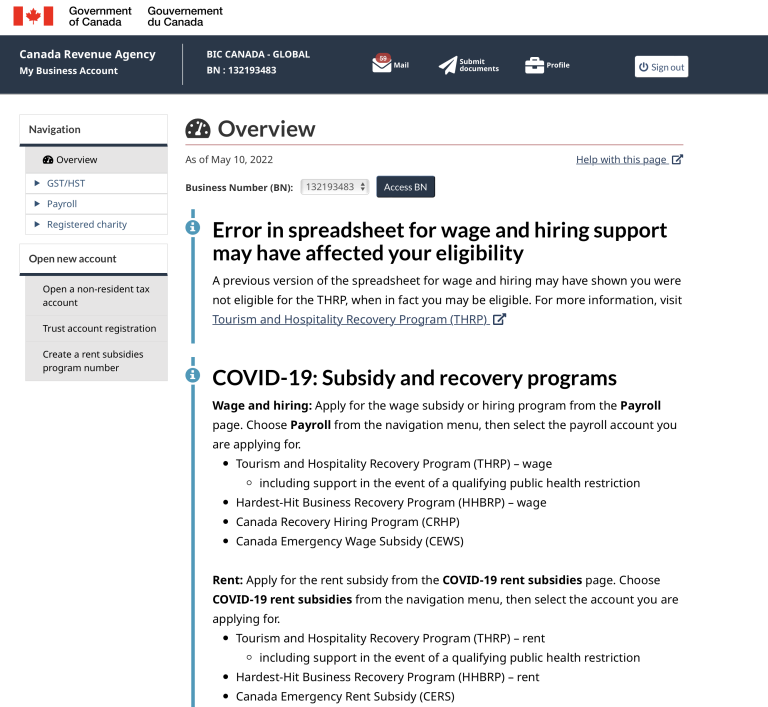

Once you have successfully logged in, you will be able to view your CRA business account.

FINDING YOUR BUSINESS NUMBER

You will need to know the business number of your church during the process of setting up your access to the Small Business CRA account for your church. You can find the business number for your church, or any charity, at CanadaHelps. Once at CanadaHelps, locate your church using the search function. Click on the link to your church’s individual CanadaHelps page.

Each charity in Canada has a CanadaHelps page with basic information about their church or charity. Here is the BIC example.

CONFIRMING AN UPDATE

It generally takes at least one week and it can take up to two weeks after you fax your letter to CRA to be added into the system. Based on previous experience with this process, normally the CRA does not notify you when the process is complete and you have been added to the account. The best way to check if you have been successfully added is to follow the instructions below and see if you are able to add the church to your account.

For a new owner to access the CRA account for their church, log on with your personal myCRA info. Then type the business number of your church and use the ‘add account’. If you’re listed as a director or owner and they have your SIN, it will connect you to the church CRA account. If you get an error code, it simply means that your account has not been set up yet and you need to check back at a later time.